21Shares filed a Form S-1 with the U.S. Securities and Exchange Commission (SEC) on April 30, 2025, to launch a spot Sui ETF. The product, named 21Shares Sui ETF, aims to track the market price of Sui (SUI) through direct token holdings.

The ETF structure does not involve leverage, derivatives, or speculative trading strategies. Instead, it will hold SUI tokens directly, according to the 128-page filing. The ETF would issue common shares of beneficial interest and operate under 21Shares’ U.S. subsidiary.

The spot Sui ETF filing marks a continuation of the firm’s expansion into the U.S. market. In July 2024, 21Shares launched the Sui Staking ETP in Europe, with listings on Euronext Paris and Euronext Amsterdam.

Spot Sui ETF Lacks Ticker and U.S. Exchange Listing

The 21Shares Sui ETF filing does not include a ticker symbol. It also does not identify the U.S. exchange where the ETF would trade. The document cautions that share prices may not match net asset value (NAV) at all times.

“There is no certainty that there will be liquidity available on the exchange or that the market price will be in line with the NAV [net asset value] or the principal market NAV at any given time,”

the filing states.

The proposed ETF will provide exposure to the Sui token price without using any synthetic or indirect instruments. It focuses solely on physical SUI token custody held by the fund.

No official launch date or listing venue has been disclosed by 21Shares as of May 1, 2025.

Canary Capital Filed First Spot Sui ETF in the U.S.

Canary Capital filed its Form S-1 registration for a spot Sui ETF on March 17, 2025. The firm became the first in the U.S. to seek approval for a spot Sui ETF. In early April, the Cboe BZX Exchange filed a separate request with the SEC to list Canary Capital’s product.

21Shares is now the second applicant for a spot Sui ETF in the U.S., entering a growing field of digital asset ETF proposals. While Canary Capital’s filing came first, 21Shares has previously launched Sui-based ETPs in the European market.

Both Canary Capital and 21Shares seek to provide regulated access to the Sui token through direct exposure, using similar filing formats.

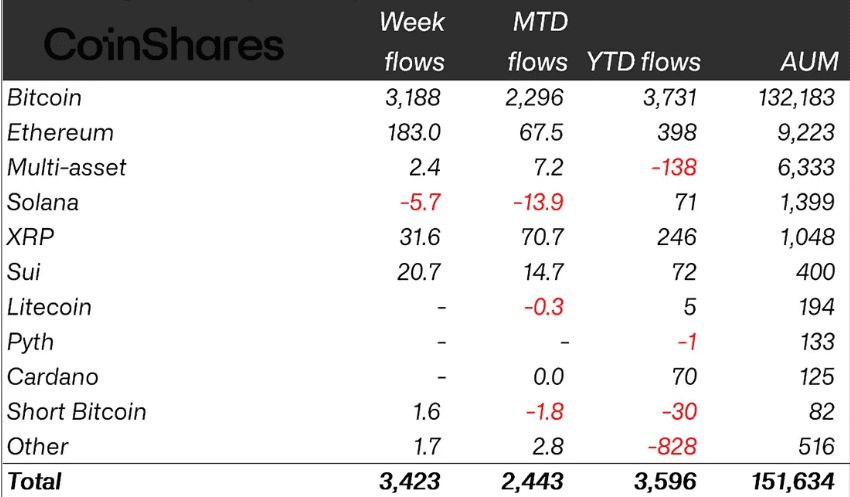

$400M in Sui ETP Assets Under Management

Data from CoinShares shows that Sui-based exchange-traded products (ETPs) held $400 million in assets under management (AUM) as of April 25, 2025. The inflows reflect increasing institutional attention to Sui-related investment vehicles.

Sui ETPs added $72 million in net inflows since the beginning of 2025. In the week leading up to April 25, they attracted $20.7 million, according to the report.

The AUM includes 21Shares’ Sui Staking ETP and VanEck’s Sui ETP, both of which trade in Europe. These products allow investors to gain price exposure to SUI through listed securities, with holdings backed by actual token reserves.

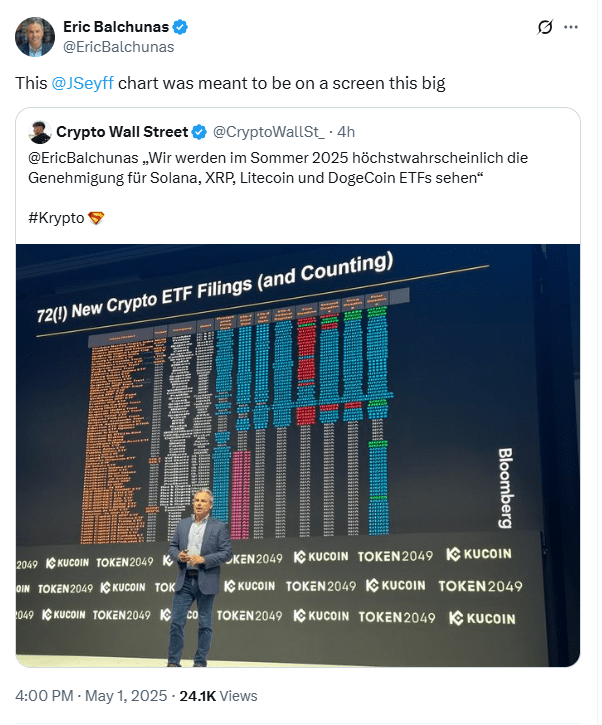

SEC Reviewing Over 70 Pending Crypto ETF Filings

The 21Shares Sui ETF filing is one of more than 70 crypto ETF proposals awaiting SEC review. Bloomberg ETF analysts Eric Balchunas and James Seyffart confirmed the number of pending filings as of May 1, 2025.

Applications include spot and futures ETFs for major tokens such as Bitcoin, Ethereum, Solana, and now Sui. While the SEC has approved some crypto-related futures ETFs, it has not yet cleared any spot Sui ETF for U.S. trading.

Moreover, Spot Sui ETF proposals from both Canary Capital and 21Shares now await the SEC’s decision. However, the agency has not provided a timeline for approval or denial of either application.