In April 2025, Cardano whale addresses holding between 10 million and 100 million ADA increased their combined balance from 12.47 billion to 12.89 billion ADA, adding 420.3 million tokens valued at approximately $289 million. This brought their total holdings to nearly 13 billion ADA, or around 36% of the total circulating supply.

On-chain data from Santiment indicated that most of the acquired tokens stayed in private wallets rather than moving to exchanges, reducing immediate sell pressure. Wallets with smaller balances showed little change during this period.

The behavior reflected similar phases in 2021 and 2023, where whales increased their positions during low-volatility conditions, contributing to gradual shifts in market structure.

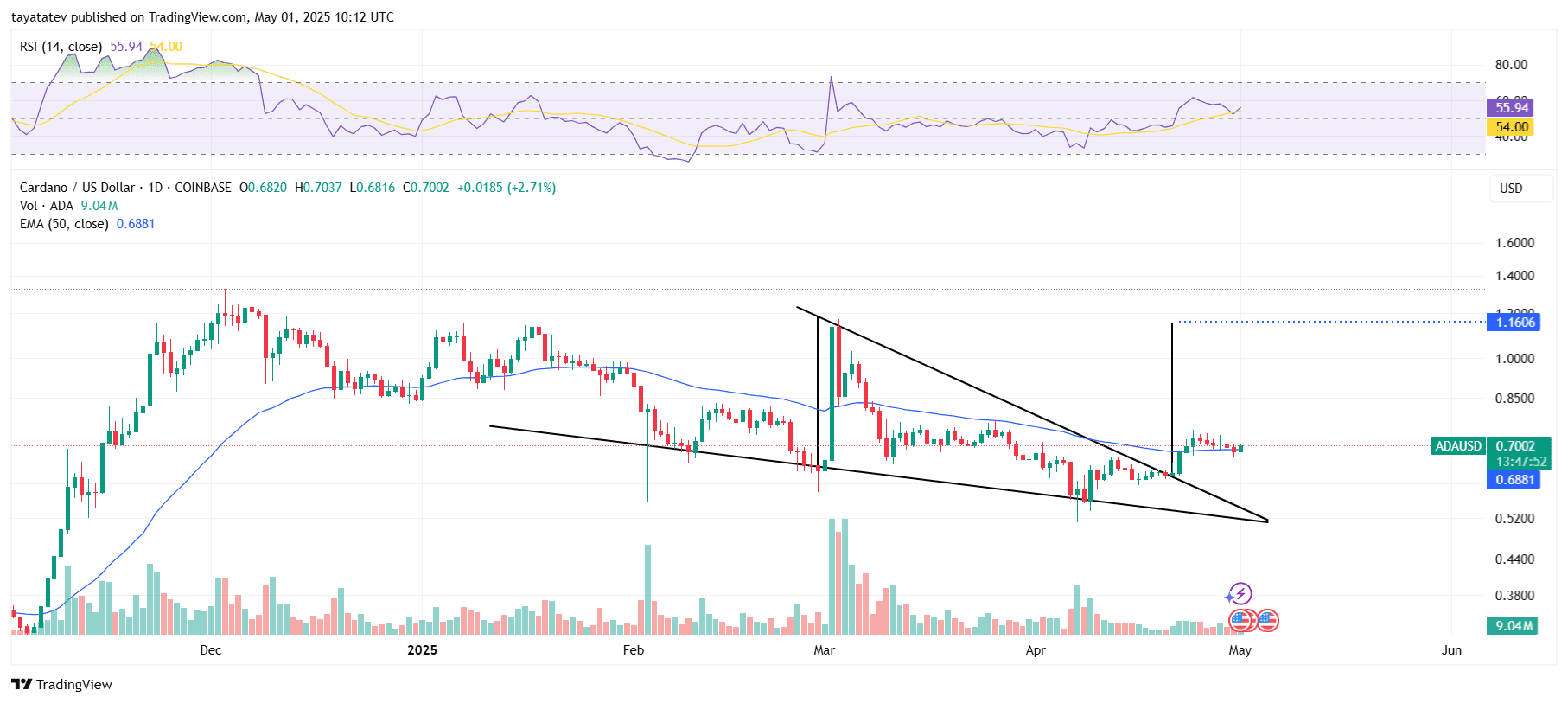

ADA Breakout Setup Confirmed With Falling Wedge Pattern

Meanwhile, on May 1, 2025, Cardano’s daily chart on Coinbase shows a completed falling wedge pattern. A falling wedge is a bullish chart formation marked by two downward-sloping trendlines that narrow over time, often signaling a potential breakout to the upside.

In this case, Cardano broke above the upper trendline in late April, confirming the end of the wedge structure. The breakout aligns with rising momentum from the Relative Strength Index (RSI), which currently stands at 55.94. This value is above the neutral 50 level, suggesting growing buying strength. The 50-day Exponential Moving Average (EMA), now at 0.6881, acts as a dynamic support just beneath the current price range.

Volume reached 9.04 million ADA during the breakout phase, supporting the strength of the move. The vertical distance from the widest part of the wedge indicates a projected upside target of nearly 66% from the breakout point. That sets a technical objective near the $1.16 level if current structure holds․

Cardano Executive Warns Against Blind Tokenization of Real-World Assets

Moreover, EMURGO COO Nikhil Joshi—representing Cardano’s commercial arm—urged caution in the growing RWA tokenization trend. Speaking in response to a post on X, he shared key insights from the “Emerging RWA Opportunities in 2025” panel and criticized the practice of placing every asset on-chain without purpose.

Joshi referred to this approach as “tokenitis” and warned that not all tokenized assets add value. He stressed that tokenization must solve real problems and avoid speculative models. His remarks reflect EMURGO’s broader role in guiding real-world utility for Cardano’s blockchain.

He identified private credit as the most viable short-term opportunity in the RWA space. Since this asset class is often opaque and illiquid, tokenization could introduce more transparency and easier access. According to Joshi, tokenized private credit offers practical application without overpromising results.

Joshi also clarified that tokenization does not always lead to higher liquidity. Instead, it can support decentralized finance (DeFi) by expanding collateral options for lending, staking, or yield generation. As part of the Cardano ecosystem, EMURGO’s stance highlights the network’s focus on utility-first tokenization strategies rather than blanket implementation.