The North Carolina crypto bill passed in the state House on April 30 with a 71 to 44 vote. Titled the Digital Assets Investment Act, or House Bill 92, the legislation now moves to the Senate.

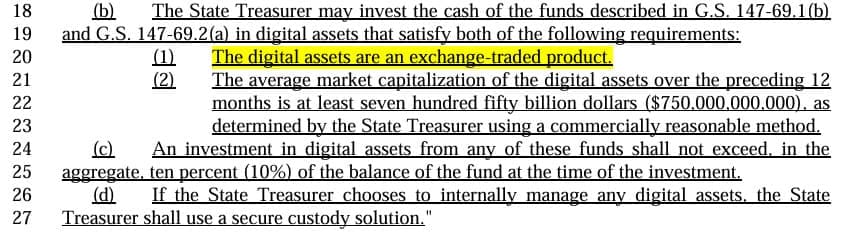

Thebill allows the state treasurer to allocate up to 5% of public funds to crypto investments, limited to approved digital assets. Introduced by House Speaker Destin Hall in February, the bill outlines strict conditions before any funds are deployed.

The treasurer must first receive an independent third-party assessment confirming secure custody, risk oversight, and regulatory compliance. Without this external verification, no investment can proceed.

The North Carolina crypto bill does not specify which digital assets qualify. It emphasizes that only designated assets are eligible once all risk and security conditions are confirmed.

Crypto ETPs May Be Offered for Retirement Plans

House Bill 92 includes an amendment giving the state treasurer authority to explore crypto options for public employee retirement savings. The treasurer may study the feasibility of adding crypto ETPs (exchange-traded products) to retirement and deferred compensation plans.

This change does not guarantee access to crypto ETPs. It only allows the treasurer to conduct a formal review. Any decision would require third-party analysis and compliance checks similar to direct investments.

The amendment aims to assess whether participants in state-sponsored savings programs could select digital assets through regulated exchange products. The bill maintains that these potential offerings must align with security and risk rules before they become available.

This section of the North Carolina crypto bill remains at the evaluation stage, pending more data and future decisions by the treasurer’s office.

HB 506 Creates the North Carolina Investment Authority

Alongside House Bill 92, the North Carolina House passed another bill on April 30 — HB 506, the State Investment Modernization Act — by a 110 to 3 vote. This bill proposes establishing the North Carolina Investment Authority (NCIA).

If signed into law, HB 506 would transfer investment control from the state treasurer to the NCIA. This agency would oversee all asset management, including crypto investments, once approved by its board.

Like House Bill 92, HB 506 also requires third-party assessments before the NCIA makes any crypto-related decisions. The new board would follow the same custody and compliance standards as laid out in the Digital Assets Investment Act.

According to NC Newsline, Treasurer Brad Briner supports both bills. The proposed authority structure would separate investment duties from the treasurer’s office and hand them to a new body governed by an independent board.

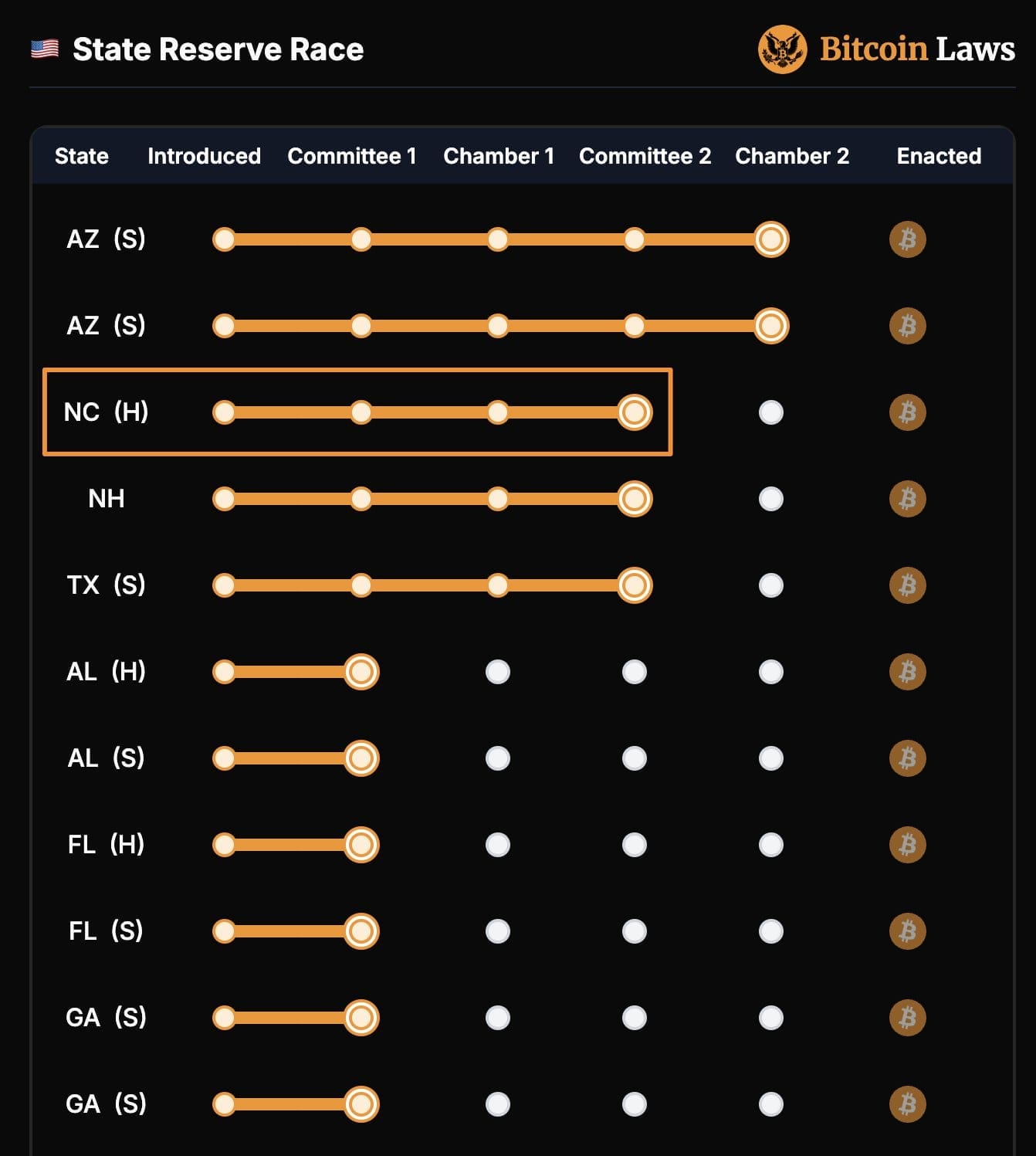

Arizona Leads in State-Level Crypto Legislation

North Carolina is not the first state to pass a crypto investment bill. Arizona leads the current race in state-level crypto legislation. On April 28, Arizona’s House approved two bills: SB 1025 and SB 1373.

These proposals lay out different paths for Arizona to build a state crypto reserve. Both bills cleared the state House and Senate and now await action from Governor Katie Hobbs.

The North Carolina crypto bill does not mention creating a reserve. Instead, it focuses on asset allocation limits, custody, and retirement investment options through regulated instruments.

The Arizona crypto bill efforts go further by preparing for full crypto-backed reserves as part of state fund structures.

Other States Join Legislative Push on Digital Assets

New Hampshire also moved forward with a crypto bill. Its proposal to create a Bitcoin reserve has reached a full Senate vote. This adds to the growing list of states considering direct government-level exposure to digital assets.

The North Carolina Investment Authority, if created under HB 506, would handle state asset portfolios, including any potential crypto investments, using external risk assessments.

Both North Carolina bills—House Bill 92 and HB 506—reflect a structured, cautious approach to digital asset exposure. The process includes clear limits, regulatory checks, and oversight layers.

These bills mark a shift in how state governments handle crypto legislation, placing North Carolina next to Arizona and New Hampshire in a growing policy trend at the state level.