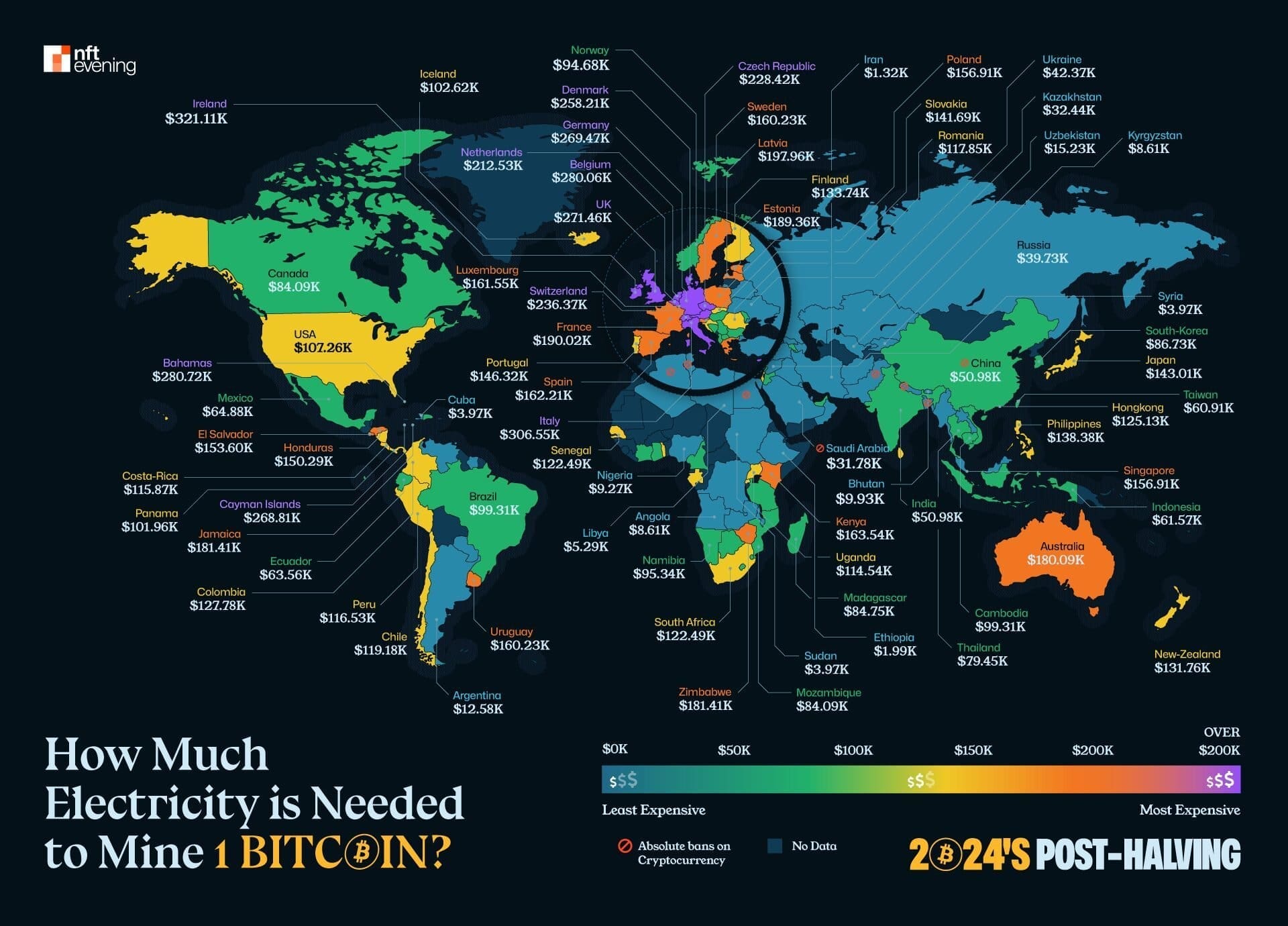

Russia has become the world’s most cost-effective Bitcoin mining region. After Bitcoin’s 2024 halving, the cost to mine one BTC in Russia dropped to just $39,730, while the global market price remains around $95,000. This 58% profit margin places Russian miners at a unique economic advantage.

Massive Profit Margins Outpace Global Rivals

In comparison, mining one Bitcoin in the U.S. costs $102,260—more than double Russia’s expense. Meanwhile, in Germany, miners face a steep cost of $269,470 per BTC, making operations nearly unviable without subsidies or alternative energy sources. Even in energy-rich Canada, the cost stands at $84,090, more than twice Russia’s figure.

Kazakhstan, another low-cost mining country, comes close at $32,440, but regulatory uncertainty limits growth. Meanwhile, countries like Ireland ($321,110) and Italy ($306,550) remain economically infeasible for mining.

Russia’s dominance stems from its vast reserves of cheap electricity, much of it hydro or nuclear-based. Cold weather also helps minimize cooling costs—another critical factor in mining profitability. Data from nft evening’s post-halving map confirms Russia as the world’s cheapest place to mine Bitcoin.

Recent reports suggest miners in regions like Irkutsk are ramping up operations. These zones enjoy power costs far below global averages, with infrastructure already optimized for industrial-scale mining.

Miners Flock as Regulations Offer Clarity

In November 2024, Russia enacted a comprehensive cryptocurrency tax law, establishing a structured taxation framework for crypto miners and traders. Under this law, individuals earning up to 2.4 million rubles annually from cryptocurrency activities are taxed at 13%, while those exceeding this threshold face a 15% tax rate. Starting in 2025, corporate entities engaged in cryptocurrency mining will be subject to a 25% corporate tax rate

The legislation also recognizes digital currencies as property, granting them legal status and allowing their use in cross-border transactions under Russia’s experimental legal regime. Additionally, mining operations are exempt from value-added tax (VAT), and mining infrastructure operators are required to report their services to local authorities quarterly, with penalties for non-compliance.

These regulatory measures aim to provide clarity and legitimacy to the cryptocurrency industry in Russia, encouraging growth and investment despite international sanctions or macroeconomic challenges.

The country’s total number of mining farms jumped 7% last year, reaching over 136,000. The industry’s expansion reflects a growing belief that Russia will remain a mining powerhouse in the post-halving era.

Electricity Cost Becomes a Global Divider

Electricity cost is now the primary factor separating profitable mining hubs from failing ones. Miners in the Bahamas ($280,720), the UK ($271,460), and Belgium ($280,060) must operate with extremely high electricity bills, often wiping out returns. By contrast, countries like Cuba ($3,970), Sudan ($3,970), and Libya ($5,290) appear cheap on paper but lack the infrastructure and regulatory clarity to support stable mining operations.

In Asia, China sits at $50,980 per BTC—slightly more expensive than Russia but still highly competitive. India matches China at $50,980, while Japan climbs to $143,010. These figures show how location now determines mining feasibility more than hardware.

With Bitcoin’s price hovering near $95,000, Russia’s energy advantage may define the next era of global mining. Unless energy prices or regulations shift drastically, Russia will likely stay ahead of the competition.