The US Treasury expects the stablecoin market to reach $2 trillion by 2028, according to its Q1 2025 report. The report from the Treasury Borrowing Advisory Committee (TBAC) attributes the growth to changing market structures, incentives, and strong demand for dollar-pegged digital assets.

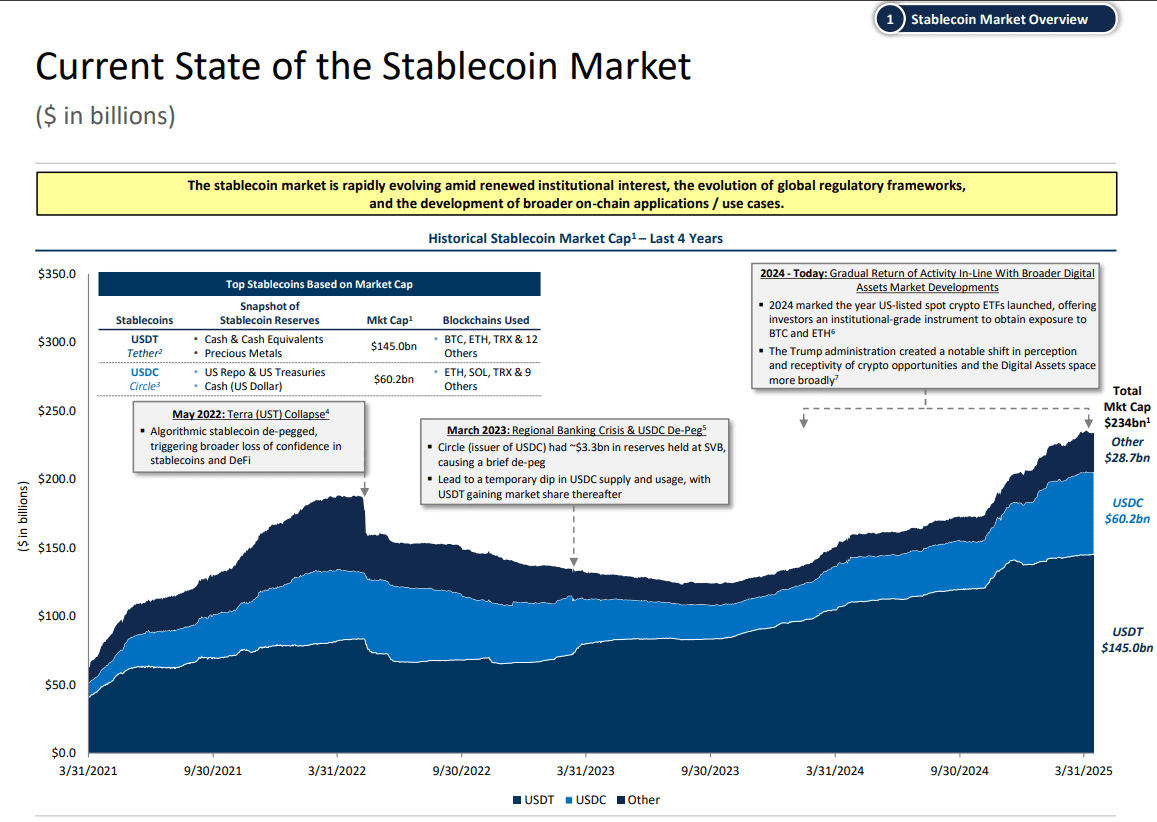

As of April 2025, the total stablecoin market cap stands at about $234 billion. The Treasury noted that 99% of this market is dominated by USD-pegged stablecoins. The projected increase would represent an eightfold rise within three years.

Under new regulatory expectations, stablecoin issuers would need to hold reserves in short-term US Treasury bills. This requirement would tie the expansion of stablecoins more directly to the US debt market and T-bill demand.

Tether Plans US-Only Stablecoin by 2026

Meanwhile, Tether CEO Paolo Ardoino confirmed that the company is discussing the launch of a US-only stablecoin. The new product could be released by the end of 2025 or in early 2026, depending on regulatory developments.

In an interview, Ardoino said,

“We are just exporters of what we believe to be the best product the United States ever created — that is, the US dollar.”

Tether is the issuer of USDT, the largest stablecoin with over 60% market share.

This announcement came amid reports that the Trump administration sees stablecoins as financial tools for expanding US influence in crypto markets. No formal decision has been issued by federal agencies on the proposed stablecoin.

USDT Market Cap Surges Ahead of US Dollar Supply

A chart from TradingView compared the market cap of USDT with the US dollar in circulation. The USDT supply (blue line) has grown steadily since November 2023. Meanwhile, the US currency in circulation (red line) has remained flat.

The data highlights the rising importance of stablecoins in digital finance. USDT now accounts for more than 60% of all stablecoins and continues to grow. As stablecoin adoption expands, the connection between digital assets and Treasury markets becomes stronger.

This trend also reflects shifting investor preferences. While the Fed’s money supply remains steady, stablecoins are gaining traction in crypto markets and financial applications.