Pi Coin continues to lose ground as broader market trends move in the opposite direction. In April, its price fell 15%, closing at $0.6077. While other major tokens rallied with Bitcoin’s push toward $100,000, Pi struggled under growing selling pressure.

Selling Pressure Keeps Pi Network Underwater

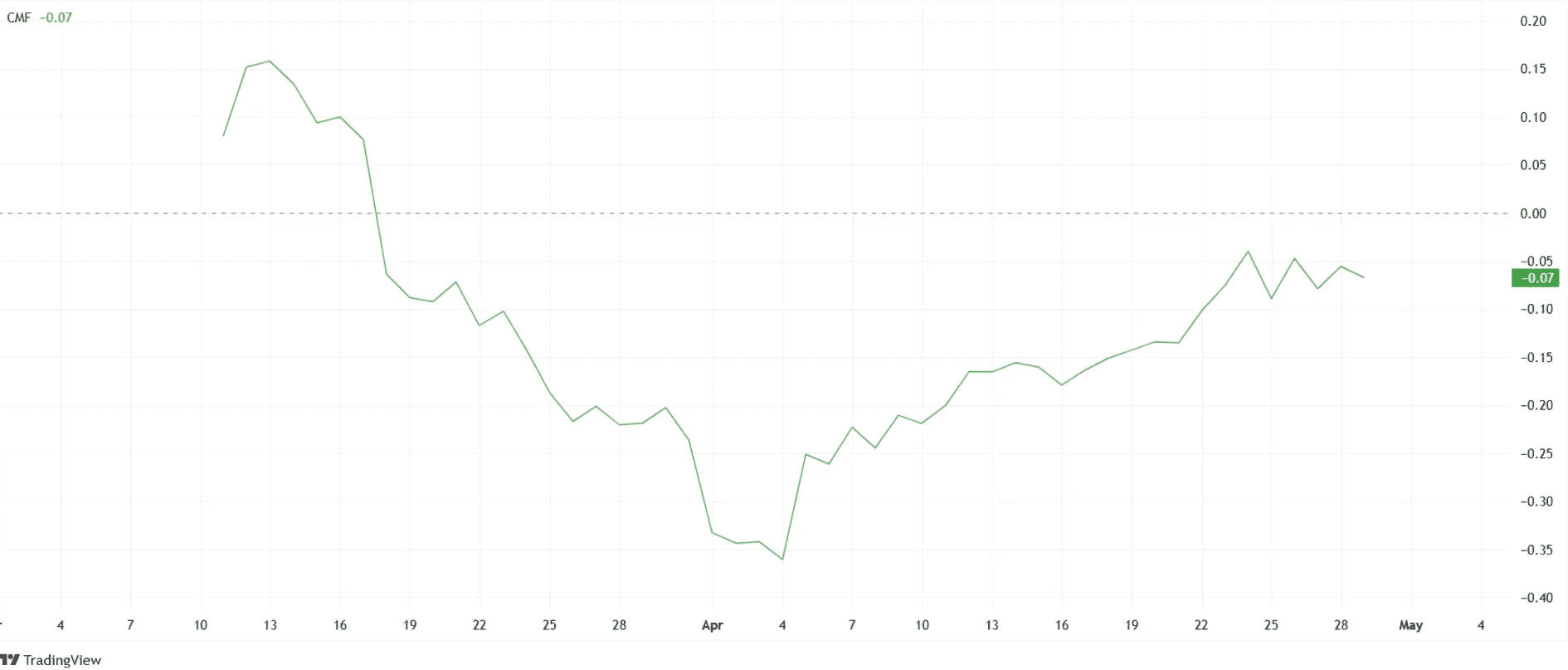

The Chaikin Money Flow (CMF), an indicator that tracks whether money is flowing into or out of an asset, remains in negative territory—showing that outflows still dominate. Despite occasional inflows, these haven’t been enough to shift the balance. The data suggests investors are still exiting Pi rather than accumulating.

The CMF reading below the zero line signals continued control by sellers. Pi Network’s recent trading behavior reflects low investor confidence and insufficient demand to reverse the trend. The network still lacks exchange depth and broader adoption, which limits its ability to absorb sell pressure.

Inverse Bitcoin Correlation Threatens Further Decline

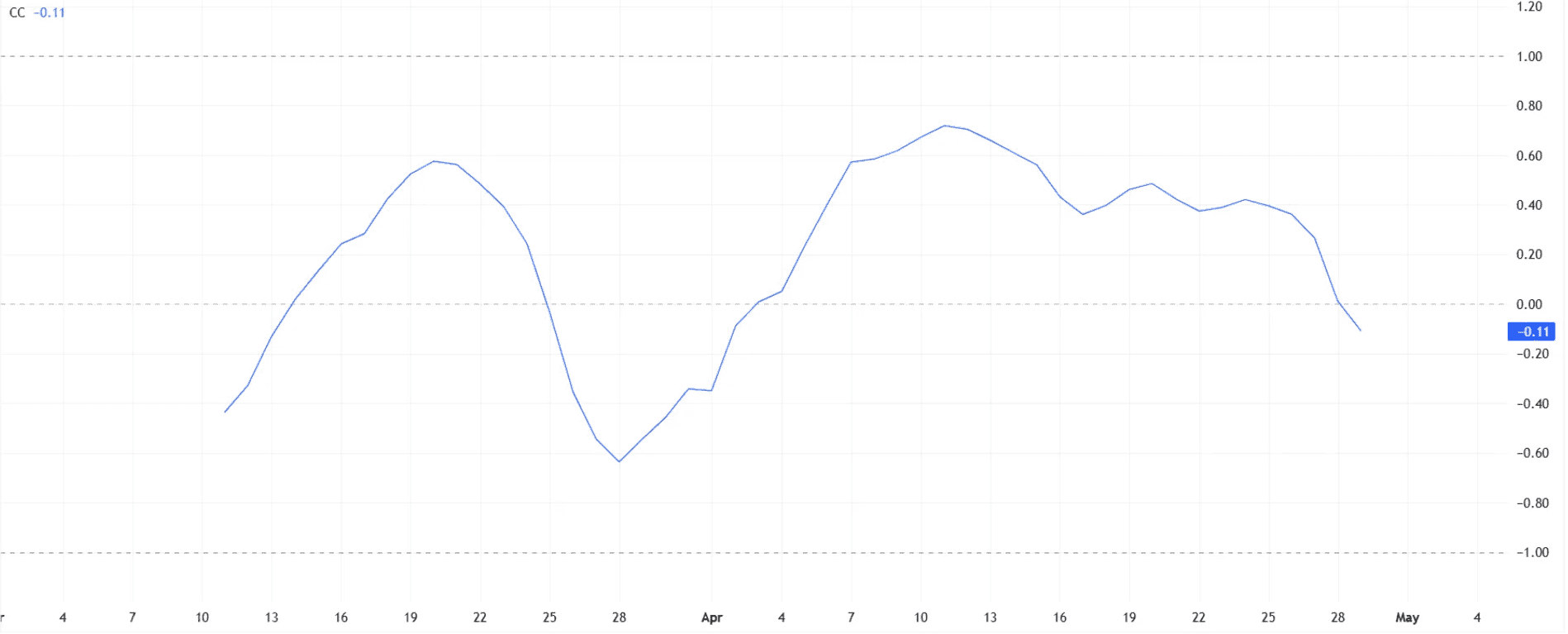

Pi’s negative correlation with Bitcoin adds more pressure to its outlook. A correlation coefficient of -0.11 means Pi usually moves in the opposite direction of Bitcoin. When Bitcoin gains value, Pi often loses value. Right now, as Bitcoin pushes toward the $100,000 level, Pi could face more selling, especially if investors move funds into stronger-performing assets.

If Bitcoin continues to rally, this inverse relationship could cause Pi’s price to drop even more. Without fresh demand, strong inflows, or a clear use case to support growth, Pi may struggle to gain momentum or rise above its key resistance levels.

To shift the momentum, Pi must reclaim $0.8727 and hold it as support. Until that level flips, the trend stays bearish. Breaking through would open the path toward $1.00, but without new investor activity or ecosystem growth, that scenario remains distant.

The recent price drop has led the Pi Network community to blame the delay in Binance listing. However, others see it as a planned strategy.

Instead of rushing, Pi Network is avoiding the early listing trend that often causes sharp price drops and volatility. Delaying the Binance debut protects long-term holders from short-term traders and pump-and-dump activity.

Meanwhile, the delay helps the team keep better control over token supply. Without access to high-volume exchanges, large holders (whales) can’t manipulate the price easily. This gives the project time to build real utility—such as in-app payments and decentralized apps—before going fully public.

Additionally, the delay keeps the community focused on development, not just token price. Without immediate liquidity, users stay engaged with Pi’s long-term mission. At the same time, the team appears to be working on legal compliance across different countries, which may lead to smoother and more credible listings later.