NOIDA (CoinChapter.com) — Ripple’s XRP token price underperformed both Bitcoin and Ethereum despite a favorable technical setup and heightened ETF expectations. XRP price surged to a local high near $2.31 on April 29 after breaking above a falling wedge pattern on April 27.

However, the move proved short-lived. Sellers quickly regained control, resulting in XRP price moving downward. The lack of follow-through signals caution among traders.

Meanwhile, Bitcoin continued its upward climb, holding near the $95,000 mark and extending April gains amid consistent spot ETF inflows and strong institutional interest. Ethereum mirrored the momentum, stabilizing above $1,800 after bouncing from monthly lows.

Both assets benefit from mature market infrastructure, approved spot ETFs, and improved investor confidence — three key ingredients XRP still lacks.

XRP’s inability to sustain bullish momentum despite a technical breakout reflects persistent skepticism. Even after the SEC dropped its appeal in Ripple’s lawsuit, investors appear unconvinced. The contrast with Bitcoin and Ethereum, both of which now trade with ETF tailwinds, underscores the structural disadvantage XRP faces.

XRP Bulls Show Weak Conviction

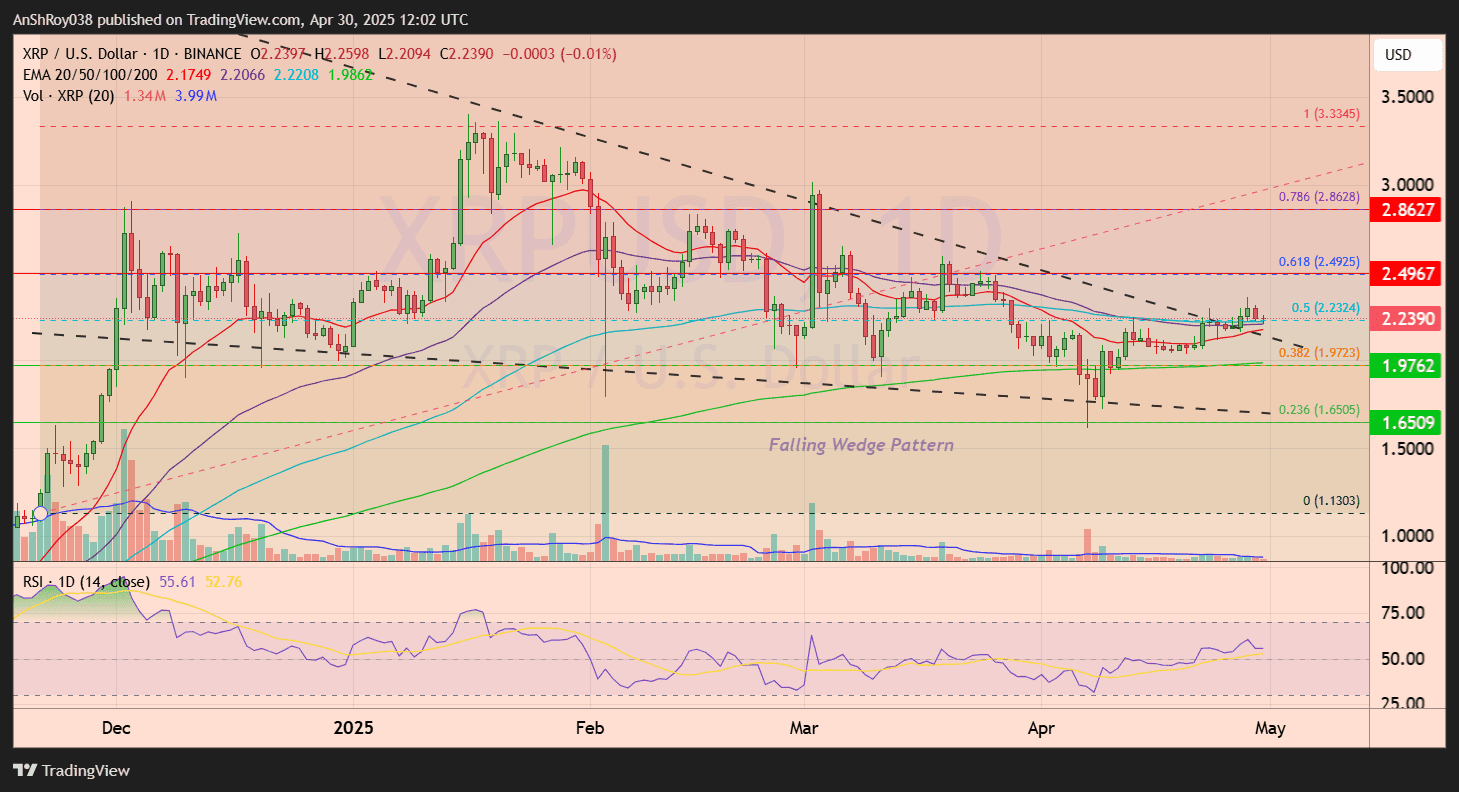

XRP has broken out of a multi-month falling wedge, but the follow-through has left much to be desired. The breakout, near the $2.17–$2.20 zone, briefly pushed the price toward $2.31. However, the move stalled just below the 0.5 Fibonacci retracement level, near $2.23, and failed to challenge the stronger resistance near $2.5.

The token now trades sideways near $2.23, showing early signs of exhaustion and hesitation among buyers. Immediate resistance lies near $2.49. A clean break above that level could extend the rally toward the $2.86 zone, marked by the 0.786 Fib retracement.

On the downside, support is now near $1.97, aligned with the 0.382 Fib level and below the 50-day EMA. Losing this zone could open the door to a deeper correction toward the $1.65 region, which coincides with the 0.236 Fib retracement.

The Relative Strength Index (RSI) remains flat near 55, showing a neutral bias. Volume has also dropped post-breakout, signaling a lack of conviction behind the move. XRP’s inability to hold momentum after escaping a technically bullish structure suggests that traders remain unconvinced. Unless bulls reclaim $2.49 with strong volume, XRP risks slipping back into a consolidation phase.

ETF Rejection Highlights Regulatory Skepticism

The technical hesitation in the Ripple token’s price mirrors the regulatory limbo surrounding its ETF ambitions. On April 30, the SEC formally rejected WisdomTree’s spot XRP ETF application, citing the same concerns it has reiterated since 2022, despite a new administration and a more crypto-aligned SEC chairman, Paul Atkins.

The rejection underscores the agency’s entrenched skepticism toward XRP’s market infrastructure, regardless of political shifts. The SEC’s decision rests on three key objections. First, it argues that XRP’s spot markets remain vulnerable to manipulation due to fragmented liquidity and inconsistent oversight.

Most trading occurs on offshore platforms lacking proper surveillance, making it difficult for U.S. exchanges to ensure fair pricing. Second, the absence of any formal surveillance-sharing agreement between a U.S. exchange and a major XRP trading venue violates one of the SEC’s core requirements for spot ETF approval.

Third, the agency points to investor protection risks, especially around XRP’s price volatility and susceptibility to sharp drawdowns — concerns that directly reflect the weakness in the current technical setup.

These arguments appear increasingly disconnected from the broader political narrative. With Trump back in office and Atkins known for criticizing overregulation, many expected XRP to receive expedited ETF clearance. Futures-based XRP ETFs, including leveraged and inverse products, have already been approved.

Yet the SEC continues to block a spot equivalent. The contradiction raises questions about the agency’s internal inertia and unwillingness to treat the Ripple token on the same terms as Bitcoin and Ethereum, both of which have fully approved spot ETF structures.

However, the BTC and ETH spot ETFs faced similar delays, which is a silver lining for XRP ETF hopefuls.